Finding Affordable Home Insurance Quotes in Myrtle Beach, South Carolina

February 27, 2024, by Brad Davis, CIC

Introduction:

Myrtle Beach, South Carolina, with its beautiful beach, is an ideal place to call home. If you're in the process of purchasing a property in this oceanside community, understanding the factors influencing homeowner insurance costs can be helpful.

In this blog post, we'll dive into what affects home insurance premiums in the Myrtle Beach area and provide tips on securing an affordable quote.

First Things First, How Much Does Myrtle Beach Home Insurance Cost?

So, the question is - How much is home insurance in Myrtle Beach, SC? Here we go!

Keep in mind, there are several factors (shown further below), and your premium could (and probably will) vary from this. But in our agency, our average home insurance premium for a primary or secondary home in Myrtle Beach, SC is right about $2,592 for a year (and rising). This is really just to give you an idea of how much you can expect to pay for Myrtle Beach Home Insurance. Rental properties are a little different.

If you are looking for Condo Owners Insurance (HO6) feel free to visit our website page for Condo Units.

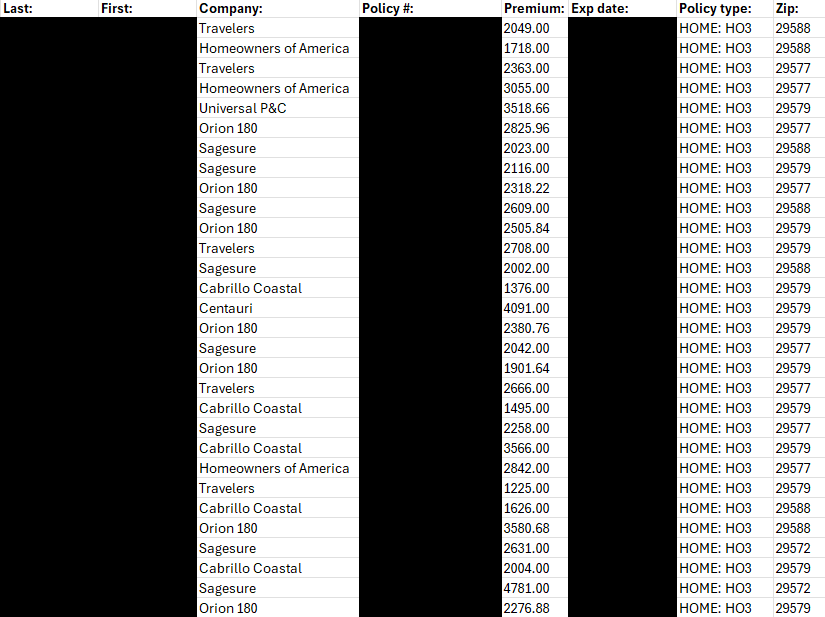

Here is a small sample of the home insurance policies I pulled from the Myrtle Beach area that we carry - just to show I didn't pull $2,592 completely out of the air. This encompasses Myrtle Beach and areas knows as Carolina Forest and Socastee (29572, 29577, 29579, & 29588).

*This is just a sample of home insurance policies that are in Myrtle Beach. Average premiums will be different almost everywhere. The average age of the home, location, and many other factors will impact this. Some of these homes have Dwelling Coverage (Coverage A) of $175,000 and some have close to a million.

IT IS COMMON TO SEE PREMIUMS IN THE RANGE OF $1,200 - $6,000 (and beyond) FOR HOME INSURANCE IN THE MYRTLE BEACH AREA.

Request a Home Insurance quote from Davis Insurance Associates.

Factors Impacting Home Insurance Costs:

Coastal Proximity:

Since Myrtle Beach sits directly on the Atlantic Ocean, home insurance rates are influenced by the increased risk of hurricanes and tropical storms.

Home Characteristics:

Factors like age, construction, and square footage can significantly impact insurance costs. Newer, well-constructed homes may qualify for discounts.

Insurance History:

Homes with a history of frequent claims may be considered higher risk, resulting in higher insurance premiums.

Local Fire Protection:

Homes not located close to a fire station (usually five miles) will typically pay higher insurance premiums due to longer emergency response times.

Credit Score:

Maintaining a good credit history is crucial, as it can positively or negatively influence insurance rates.

Deductible and Coverage Limits:

Adjusting your deductible and coverage limits can directly affect your overall premium. It's pretty well known that higher deductibles can lower your premium.

Check out our other blog posts about Home Insurance.

Understanding Average Costs:

While average home insurance costs in South Carolina are approximately $1,500 annually, specific rates in Myrtle Beach are typically higher. It's essential to consider the unique factors that apply to this community when obtaining quotes for accurate pricing. As mentioned above, the age of your home plays an important part in the home insurance rate. Homes over 20 years old can pay up to double the premium when compared to a new home.

Tips for Affordable Home Insurance:

Bundle Policies:

When you can, combine home and auto insurance with the same provider (or agency) to benefit from potential discounts.

Home Security Systems:

Install security systems to make your home less risky to insure and potentially qualify for discounts.

Maintain a Good Credit score:

Regularly check and improve your credit score to qualify for lower insurance rates.

Conclusion:

If you're in the market for a home insurance quote in the Myrtle Beach area, understanding the local factors influencing costs is key. By considering coastal risks, home characteristics, and implementing cost-saving measures, you can find an insurance policy that not only protects your investment but also fits within your budget. For personalized advice tailored to your needs, consult with insurance professionals who are familiar with the specific considerations of insuring homes in Myrtle Beach, SC.

Lastly - Be careful if you are only searching for the cheapest home insurance in Myrtle Beach. You may find that companies advertising they have the lowest rates in Myrtle Beach or certain areas are not the best fit for you. Work with a trusted agency that is looking out for you while also looking for ways to bring you the best value!

Care to see what we can do for your home insurance? Please visit ThinkDavisInsurance.com or call (843) 213-0000.

ThinkDavisInsurance.com

HOME | AUTO | FLOOD

We are your local independent insurance agency for Myrtle Beach providing you with peace of mind at a price that's right for you. Let Davis Insurance Associates help you find affordable home and auto insurance in South Carolina and North Carolina.